Contents:

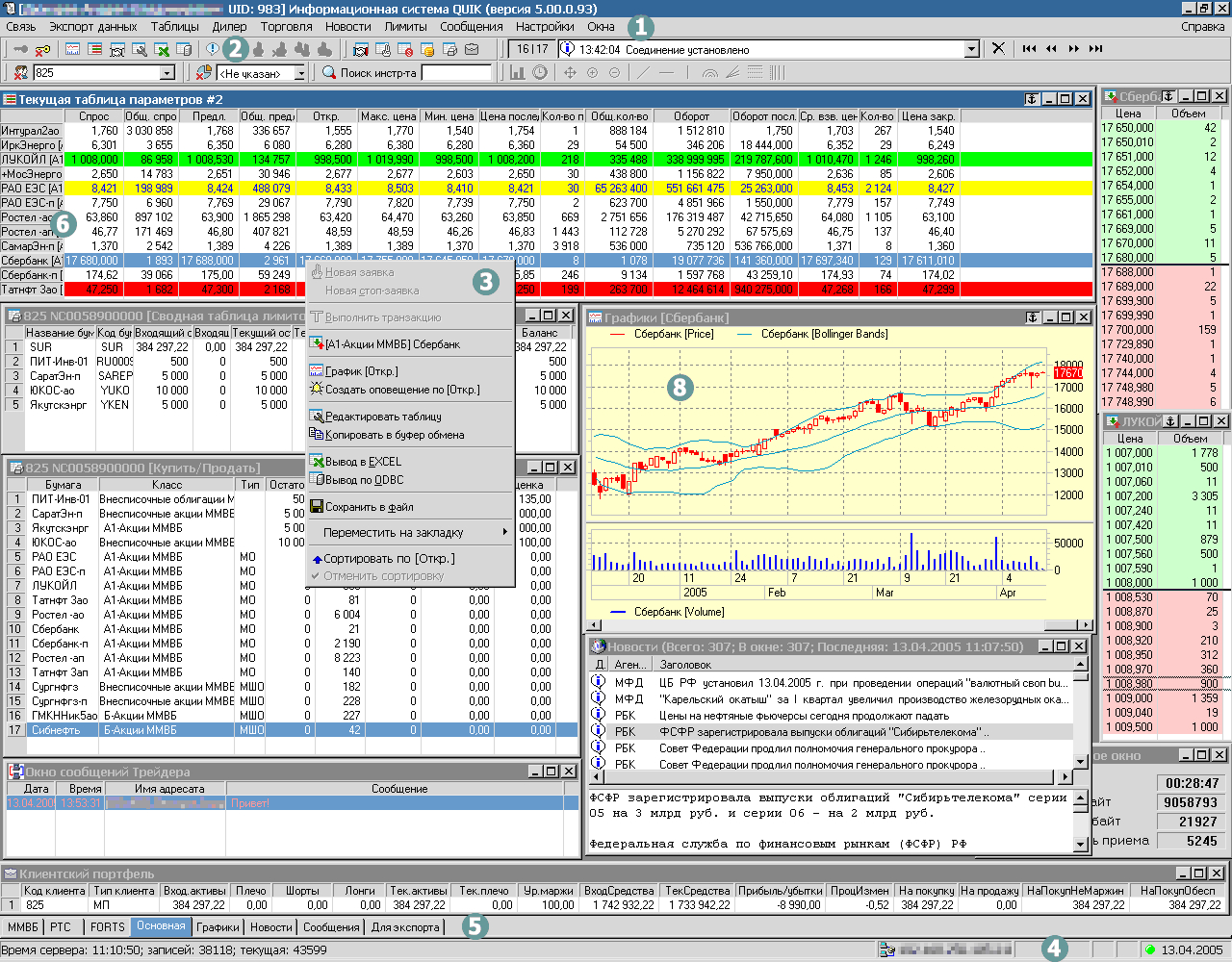

Harness past market data to forecast price direction and anticipate market moves. How to be a successful investor — investment insights, strategies, and education on stocks, ETFs, crypto, real estate, and more. There are various types of popular trading signals that can be used with the Relative Vigor Index, the two most commonly used being RVI Divergences and RVI Crossovers. Once you’ve chosen your period, you’ll then need to identify the Open, High, Low, and Close values for the current bar you’re analyzing. With that, we come back to the famous divergences or confirmations of the course itself.

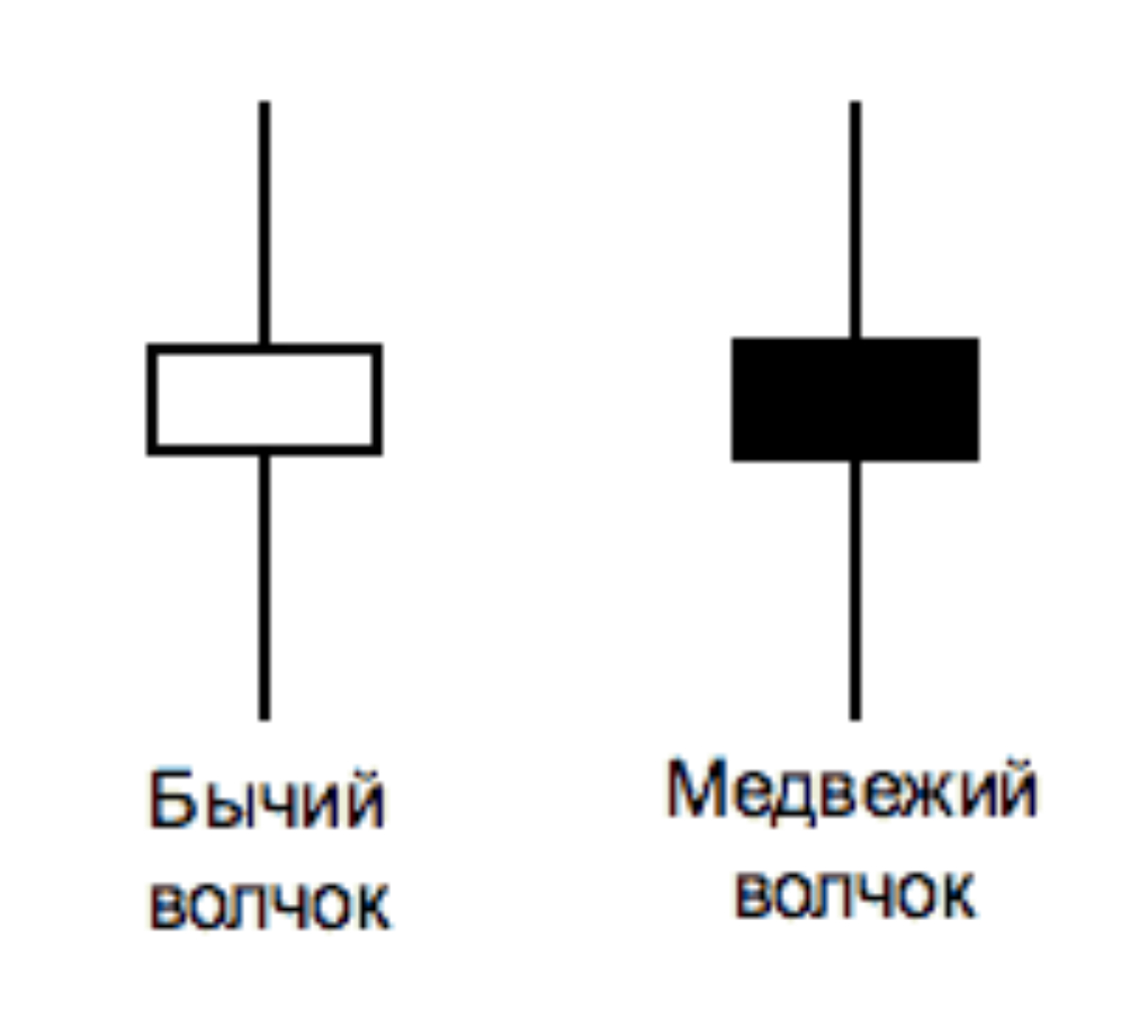

Similarly, a bearish divergence will occur when the price is making higher highs, but the RVI makes lower highs. When a bearish divergence occurs, traders will look for opportunities to place sell orders in anticipation of a downward price reversal. The Relative Vigor Index is a momentum oscillator that compares the closing price of a security to the range of its prices over a given period of time. It is designed to indicate the strength of a current trend by comparing the closing price to the range of prices over a certain period of time. The principle behind the RVI Indicator is that it uses the relationship between an instruments opening and closing prices to determine whether the market is bullish or bearish.

The chart also shows that not every crossover results in a reversal. Thus, it is very important to use the indicator well and in combination with other indicators to confirm trends. The RVI was presented to the trader community in 2002 by a famous developer of technical indicators and automatic trading strategies John Ehlers. The indicator compares the closing and opening prices and helps to define who are dominating the market – the bears or bulls. The Relative Vigor Index indicator is classified as an oscillator since its values fluctuate between computed positive and negative values.

Have You Ever Thought About A “Super Winning” Strategy In Forex Trading?

https://forexhero.info/ works best between M15 to H1 timeframe charts but can be applied to trade any Forex currency pair at the Forex MT4 trading terminal. For its greater signal accuracy and simplicity of chart display, newbie traders are widely accepting it for their daily trading operations. The default period for most platforms and also for TradingView is 10. The signal line equation smoothes the RVI line using a weighted moving average over four periods.

- As with most indicators, the RVI was created with the commodities market in mind.

- Harness the market intelligence you need to build your trading strategies.

- The Relative Vigor Index is a technical analysis indicator that measures the recent price action of an asset and estimates the probability that it will continue in the short and medium term.

- Determine your entry point after the initial Blue divergence line has completed, denoted by the Green RVI line crossing both the signal line and the zero midline in an upward thrust.

CFDs are complex instruments and come with a high https://forexdelta.net/ of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This week is unlikely to bring unexpected news and decisive changes, but it will require market participants to pay close attention to policy signals and the release of some data.

Relative Vigor Index (RVI indicator)

For our exit point, we wait for a divergence to present itself between the rising price trend and the RVI data points. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Take profit is determined by searching for a “magnet level” – an important price point that played an important role in the past. This can be either a Fibonacci retracement/extension, moving average, trend line etc.

However, this strategy has the disadvantage that at times, the price will rise while the indicator falls or moves sideways. Whenever the RVI starts to diverge from the price, it indicates that there may be a change in the trend. The calculation method for the Relative Vigor indicator is actually very similar to that used for the Stochastic Oscillator, another very popular indicator. In contrast, the RVI uses price in comparison to the high of the day, as we have seen. We will show you how to trade the Support and Resistance Based on the 240 Bars medium-term strategy. We’ll explain the subtleties of using the SF Trend Lines indicator and the rules for setting Stop Loss and Take Profit.

The divergence of the RVI and price chart

Even Dorsey himself submitted that the https://traderoom.info/ is not an independent technical analysis indicator; it is best suited as a complimentary one. Clear Rules – By following a well-defined set of rules, traders can reduce the risk of making an incorrect decision and increase their chances of success. A bearish divergence is also present when the RVI makes lower highs and the price makes higher highs. Traders will look for sell opportunities when a bearish divergence occurs, anticipating a downward price trend.

RVI Crossovers are leading indicators of future price direction and help determine a crossover to be either bullish or bearish depending on its position above or below the signal line. If a crossover is above the signal line, it signifies a bullish indicator. If a crossover is below the signal, it signifies a bearish indicator.

Forex Categories

Please note while this example is of an overnight position, we at Tradingsim do not believe in holding positions overnight, as we are day traders. If you are a swing trader, then, of course, the above example would fit within your trading time frame. In this image, we see that the two signals we need from this trading strategy come at once.

In this step, we are going to create a list that indicates 1 if we hold the stock or 0 if we don’t own or hold the stock. In this step, we are going to plot the created trading lists to make sense out of them. In this step, we are going to calculate the components of the Relative Vigor Index by following the methods and formula we discussed before. Now that we have imported all the required packages into our python.

Standalone crossover of two moving averages shows where the trend starts end ends. Adding RVI to MACD gives you another additional confirming signal, more mobility in exiting positions, and a more detailed comprehension of the market state. The Relative Vigor Index is employed by traders who want to capitalize on trending markets. Instead of employing the HODL strategy, they effectively move in positions to make a profit based on the current trend. The indicator should be combined with other technical indicators such as MACD and RSI to confirm the trend. RVI can be used in conjunction with moving averages to confirm trends and generate trading signals.

To this end, the trading example near the end of this review will also include Bollinger Bands and an Average True Range as a complementary indicator set. The RVI is one of several oscillators offered on the MetaTrader4 platform, but there are many proprietary systems that do not include it in their indicator arsenal. It differs from most other oscillators in that there are no upper and lower regions defined within a 100% scaling. On the contrary, the RVI oscillates around a centreline zero base value. On the other hand, the interaction between the RVI and the price action can produce a bullish and bearish divergence.

How to trade with RVI

For this single reason, combining the RVI with one or two other technical tools can help seal the deal. We will demonstrate how this combination works in an actual trading example in the next section, but for now, let’s focus on the Relative Vigo Index alone to see how powerful this tool can be. Get $25,000 of virtual funds and prove your skills in real market conditions. When it comes to the speed we execute your trades, no expense is spared. Partner with ThinkMarkets today to access full consulting services, promotional materials and your own budgets.

Bitcoin’s bullish price action continues to bolster rallies in FIL, OKB, VET and RPL – Cointelegraph

Bitcoin’s bullish price action continues to bolster rallies in FIL, OKB, VET and RPL.

Posted: Sun, 19 Feb 2023 08:00:00 GMT [source]

When there is a bullish trend, continue holding the asset as long as the two lines are rising and vice versa. On the other hand, if the price is falling, continue shorting the asset as long as the two lines are declining. As with most indicators, the RVI was created with the commodities market in mind. Still, it can be used well in the other markets such as forex, stocks, and indices.

In light of its ability to predict market trends, the RVI is considered a leading indicator. The signal to buy emerges when the quick RVI line crosses the slow signal line from below in the oversold area, after a local low appears. When the price chart confirms the reversal, open a buying position with the SL behind the last low. In this case, the two divergent periods, where the RVI is declining while prices are still increasing, might be the opposite of what a trader might expect.

- If you only trade when you see agreement in signals from your two indicators, it may improve their effectiveness.

- Once you’ve done this, proceed by calculating the simple moving averages for the numerator as well as the denominator over the N period that you selected in Step 1.

- It is designed to indicate the strength of a current trend by comparing the closing price to the range of prices over a certain period of time.

As with any type of investment, it’s important to have a well-rounded understanding of the market and the risks involved. This signaled a bearish divergence as the vigor of the trend at the time was not as strong as the initial surge. A trader could preemptively open a short trade, expecting the divergence and profit on the downturn. Relative Vigor Index uses smoothening with a Simple Moving Average over 10 periods. There are two lines in the indicator (RVGI & Signal) which makes it useful for crossover trading. The indicator assumes that in a trending market, when an asset is on an upswing, the closing price of the current day will be lower than the closing price on the next day.

Leave A Comment